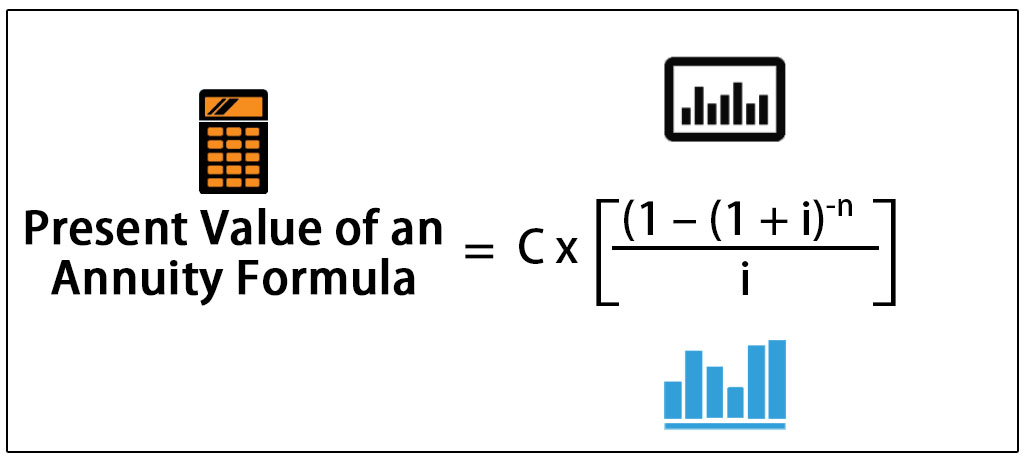

Present worth of annuity

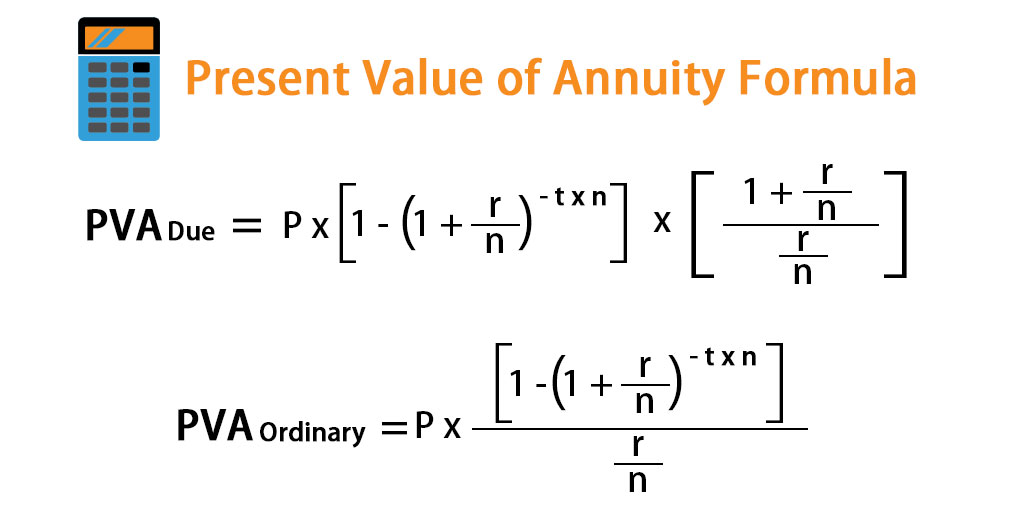

Here is the present value of an annuity formula for annuities due. R is the constant interest rate.

Annuity Formula Present Value Students Explore

C 1 cash flow at first period.

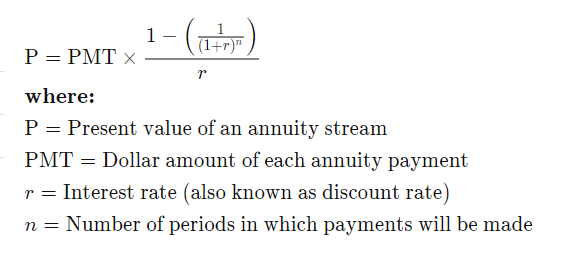

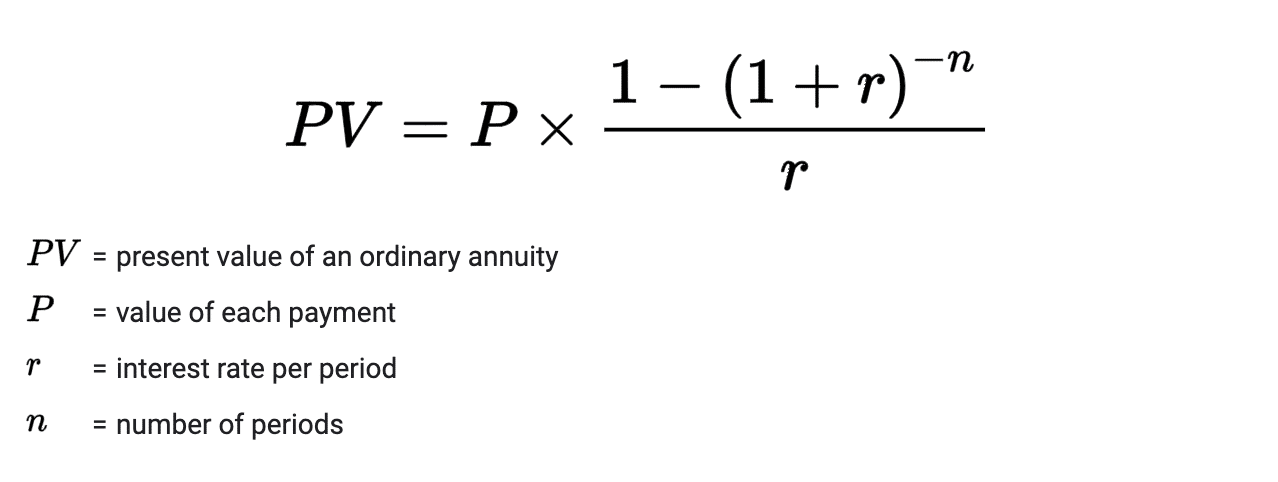

. The Present Value of an Annuity is the value of an annuity expressed in todays terms. P V P M T i 1 1 1 i n 1 i T where r R100 n mt where n is the total number of compounding intervals t is the time or number of periods and m is the. The first involves a present value annuity calculation using Formula 114.

Ad Learn More about How Annuities Work from Fidelity. Essentially there are 2 parts to this concept including. PV present value of the annuity.

It is the current value of amount to be received at a specified rate and period. Present value is the value of investment or amount today. Then shell follow that row to the.

Ad Learn More about How Annuities Work from Fidelity. You can use the following formula to calculate the present value of an annuity. The present value of an annuity is the aggregate that should be contributed now to ensure an ideal payment later on while its future value is the total that will be accomplished over a long.

Present Value PMT x 1 - 1 r -n r x 1 r Where PMT is the value of the cash flows. A simple example of a growing annuity would be an individual who receives 100 the first year and successive payments increase by 10 per year for a total of three years. The time value of money is the widely accepted conjecture that there is.

Learn some startling facts. The present value of an annuity is the current value of future payments from an annuity given a specified interest rate. R rate of return.

The present value of an annuity refers to the current total value of a persons future annuity payments. The term net in net present value means to combine the present value of all cash flows related to an investment. Annuities are often complex retirement investment products.

Note that the annuity stops one payment short of the end of the loan contract so you need to use N. Present value of an annuity Definition. PV PMT l gi gi where.

This would be a. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. Another difference is that the present value of an annuity due is higher than.

Present Value of an Annuity. N number of periods. PV the Present Value.

Ad Get this must-read guide if you are considering investing in annuities. The Present Value PV and. The present value of an annuity is the equivalent value of a series of future payments at the beginning of its duration accounting for the time value of money - meaning.

The formula for determining the present value of an annuity is PV. Curves represent constant discount rates of 2 3 5 and 7. The present value of an annuity is determined by using the following variables in the calculation.

The present value of 1000 100 years into the future. Shell look at this present value of annuity in arrears table follow the n column to the number 5 which represents her 5 annuity payments. This concept is based on the time value of money which states that.

The present value of the annuity.

Present Value Of Annuity Formula With Calculator

Present Value Of 1 Formula Shop 54 Off Www Ingeniovirtual Com

Present Value Of Annuity Formula Calculate Pv Of An Annuity

Present Value Of An Annuity How To Calculate Examples

How To Calculate The Present Value Of An Annuity Youtube

Present Value Of An Annuity How To Calculate Examples

Excel Formula Present Value Of Annuity Exceljet

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities5-d76f3a6c09a54703afa365a16aff6607.png)

Calculating Present And Future Value Of Annuities

What Is An Annuity Table And How Do You Use One

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities3-f5e4d156c37b4fffb4f150266cea32b1.png)

Calculating Present And Future Value Of Annuities

How To Calculate Present Value Of An Annuity

Annuity Present Value Pv Formula And Calculator Excel Template

Present Value Of Annuity Due Formula Calculator With Excel Template

Annuity Formula What Is Annuity Formula Examples

Present Value Of Annuity Calculation Knime Analytics Platform Knime Community Forum

Pv Annuity Calculator Sale Online 56 Off Www Ingeniovirtual Com

How To Measure Your Annuity Due